Indicators on Melbourne Finance Broking You Need To Know

Wiki Article

Some Known Facts About Best Financial Planner Melbourne.

Table of ContentsThe Facts About Finance Brokers Melbourne UncoveredThe Buzz on Best Financial Planner MelbourneUnknown Facts About Finance Brokers MelbourneThings about Best Financial Planners MelbourneFinance Brokers Melbourne Fundamentals Explained

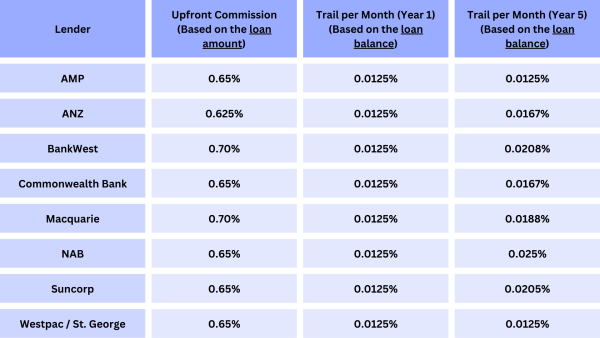

The duty of a Mortgage Broker can be confusing, specifically if you are a first home purchaser. Skilled mortgage brokers play an essential role in serving as the intermediator for you and readily available lenders. It pays to be mindful of the different pros and cons of collaborating with mortgage brokers.Home mortgage brokers usually do not charge you a cost for their service, yet rather gain compensations on money they aid in preparing from the bank. They primarily obtain paid the same per financial institution, so you don't need to fret about your broker offering you biased home funding items. Mortgage brokers will recommend mortgage products that are aligned with your unique situation.

Coast Financial stands apart among all other home loan brokers as the # 1 trusted companion that property representatives are probably to suggest in Australia. It has actually been granted the most effective, large independent home mortgage broker, which suggests you can trust that you're functioning with a broker that has the range, toughness, and experience to battle for the very best deal for you.

The Greatest Guide To Best Financial Planner Melbourne

There isn't a catch when it comes to dealing with a Home mortgage Broker, however, you do have to be careful when picking the best individual. You must constantly check their experience and qualifications - finance brokers melbourne. It is likewise essential to know that they have connections with a number of lending institutions so that you have a lot of choices when it involves selecting a lending institutionYou require to feel certain that they have your benefits in mind and that they will certainly have the ability to support you with an extremely important economic decision. You may have close friends or family participants that have a recommendation for you, or else, you can look at your existing network of financial service providers.

As a not-for-profit organisation with a lot of connections in the market, we always have your ideal rate of interests in mind.

Intermediary who promotes transactional use financial debt tied to genuine estate A mortgage broker functions as an intermediary who brokers mortgage on part of people or businesses. Commonly, financial institutions and other loan provider have actually offered their own items. As markets for mortgages have actually become much more competitive, nonetheless, the function of the home mortgage broker has come to be much more prominent.

An Unbiased View of Best Financial Planners Melbourne

Home loan brokers exist to discover a financial institution or a direct loan provider that will be ready to make a particular funding an individual is seeking. Home loan brokers in Canada are paid by the lending institution and do not charge costs for excellent credit rating applications.Lots of states call for the home mortgage broker to be licensed. A home mortgage broker is usually registered with the state, and is directly liable (culpable by abrogation or prison) for fraudulence for the life of a lending.

Finance officers that help a site here vault institution are required to be registered with the NMLS, yet not accredited. Normally, a home mortgage broker will make even more cash per loan than a finance police officer, yet a car loan police officer can utilize the referral network available from the loaning institution to offer even more financings.

The broker will after that designate the lending to a designated accredited lender based on their prices and closing speed. The lender might shut the lending and solution the funding.

Examine This Report on Melbourne Finance Broker

After that they repay their stockroom lender, and acquire a profit on the directory sale of the lending. The debtor will frequently obtain a letter notifying them their lender has actually offered or moved the lending. Lenders who offer most of their lendings and do not really service them are in some jurisdictions needed to alert the client in creating.This has actually developed an unclear and tough identification of the real cost to acquire a home loan. The federal government developed a brand-new Great Confidence Estimate (2010 version) to allow consumers to compare apples to apples in all charges related to a home mortgage whether you are going shopping a mortgage broker or a straight loan provider.

Ambiguous for the home mortgage brokers to disclose this, they determine what charges to charge in advance whereas the straight lending institution won't recognize what they make total until the loan is sold. Often they will certainly market the loan, however proceed to service the funding.

Not known Incorrect Statements About Best Financial Planner Melbourne

Mortgage lenders do not take deposits and do not find it practical to make financings without a dealer in location to buy them. The needed cash money of a home mortgage lender is just $500,000 in New York. The remainder may remain in the form of property possessions (an added $2. 00), an extra credit limit from another resource (an extra $10,000,000) (melbourne finance broking). [] That amount is enough to make just 2 typical cost home mortgage.Report this wiki page